Utilities nationwide are undertaking significant efforts to improve sustainability and reduce their environmental impact. However, the specifics of these utility sustainability goals and the steps being taken to achieve them are not always clear to the average customer.

In fact, according to J.D. Power, only 21% of U.S. electric utility customers know about their utility’s carbon reduction initiatives. Yet 80% of customers are served by utilities committed to a 100% carbon reduction target. This disconnect signals a need for better communication strategies to bridge the understanding between utilities and their customers.

The “Why” Behind Your Utility Sustainability Efforts

Effective communication helps customers understand the rationale behind a utility’s sustainability initiatives and encourages them to support these efforts. But before developing your strategy or crafting external messages, you must clearly define your utility’s sustainability mission.

Whether driven by regulatory compliance, climate change, environmental stewardship or social responsibility, your “why” shapes every aspect of your communication strategy. When your entire organization understands and embraces your underlying motivators, you can create authentic messaging that resonates with customers.

Strategies for Impactful Utility Sustainability Communication

Successfully communicating your “why” requires a comprehensive approach. Here are six key strategies to enhance your utility sustainability communication efforts:

Use Multiple Communication Channels

Utility customers come from various backgrounds and prefer different communication methods. To maximize engagement, it’s important to use a multichannel approach, incorporating email newsletters, social media posts, videos, bill inserts and articles. By casting a wide net across various platforms, you ensure your messaging reaches the maximum number of customers and that each customer can access information in their preferred format.

Each channel offers unique advantages. Social media can provide quick, visually engaging updates and allows for two-way communication, while detailed information can be provided through newsletters and articles. Using a mix of channels allows you to meet customers where they are and improves the likelihood that utility sustainability messages will resonate.

The Los Angeles Department of Water & Power (LADWP), for example, distributed a press release announcing that it ranked first in the nation in the 2024 J.D. Power Sustainability Index – an evaluation measuring the nation’s largest electric utilities’ customer awareness, support, engagement and advocacy for their local climate sustainability programs and goals. LADWP also made short posts on social media celebrating the achievement to reach a broader audience.

Personalize Messaging With Data-Driven Insights

People want to receive information that feels relevant to them. By leveraging customer data, you can segment your utility’s audience and tailor messages to specific demographics, regions or interest levels. Customers in regions affected by extreme weather events may be more responsive to messages about climate resilience initiatives. At the same time, those in urban areas might be more interested in renewable energy investments or water conservation programs.

Advanced data analytics allow you to create customer profiles based on behavior, preferences and energy and water usage patterns, making it possible to send personalized messages that speak directly to each person’s values and needs. These customized messages help customers connect with their utility’s mission on a personal level.

Leverage Storytelling

Storytelling is another powerful tool for making complex utility sustainability topics more relatable and memorable. Customers are more likely to engage with stories that evoke emotion and provide context to utility sustainability initiatives. Share narratives about how your efforts impact local communities, reduce your dependence on fossil-based energy supplies or preserve local water supply.

Highlight employee stories that reflect your utility’s sustainability values. For example, Dominion Energy developed a video and article series called “Faces of Our Sustainable Future.” One video showcased Lisa, a Senior Sustainability Specialist who identifies opportunities to make her workplace greener and works to implement sustainable solutions.

By humanizing your initiatives through storytelling, you create an emotional connection that helps customers understand your sustainability goals.

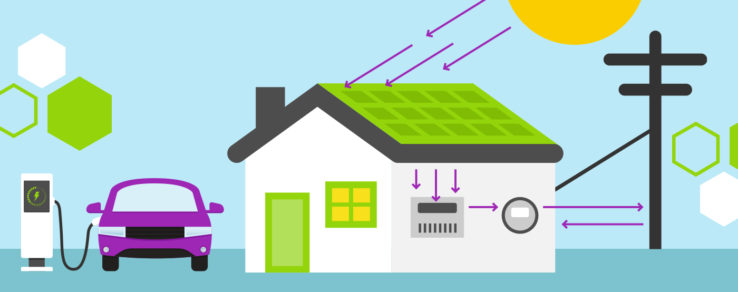

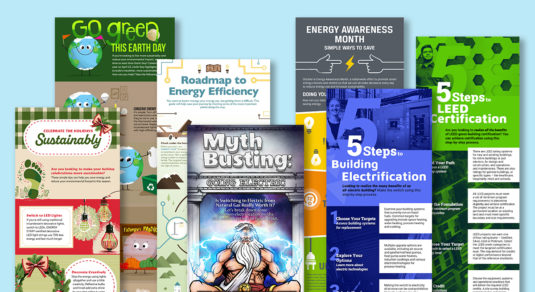

Visualize Information

Sustainability topics can sometimes be complex and challenging to understand, especially if they involve technical details or unfamiliar concepts. Visual content helps simplify these ideas and make them more digestible. Infographics, videos and animations can break down information into easily understood formats.

An infographic could illustrate how a utility’s energy mix has shifted from fossil fuels to renewables over the years or explain how new energy-efficient technologies benefit both customers and the environment. Videos showing behind-the-scenes footage of a sustainable energy utility’s projects can also capture customers’ attention and make these efforts feel real and relatable.

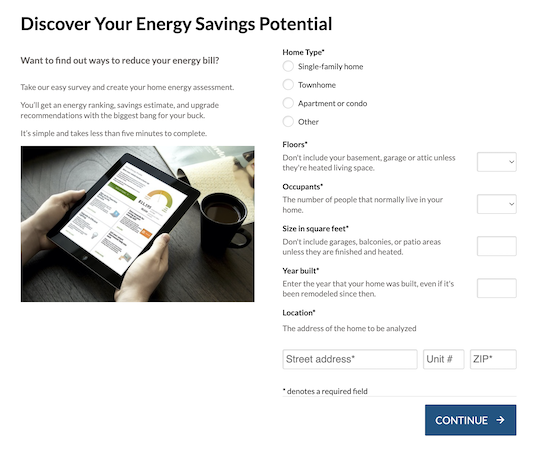

Empower Customers With Resources

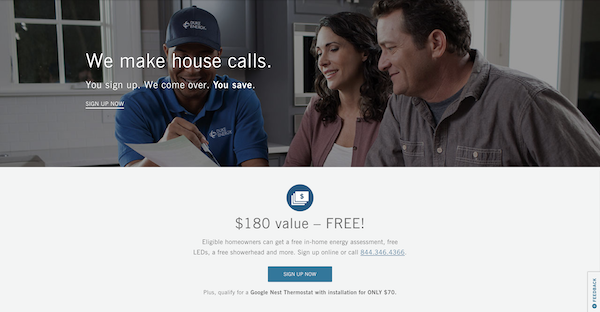

To foster support, your utility can empower customers with resources that help them participate in utility sustainability efforts. Providing educational materials about energy-saving practices, explaining renewable energy options and offering guidance on water conservation are ways to help customers feel they’re part of the sustainability journey. E-newsletters can help deliver these resources and build engagement by going beyond promotions and transactional messages.

Dedicated webpages also give customers easy access to a one-stop shop for utility sustainability information and tools. Georgia Power, for example, has an environmental stewardship webpage that includes resources for caring for the natural world, both at home and in the community. There are tips for saving energy at home, a link to enroll in paperless billing, a tool for calculating how much money and greenhouse gas emissions can be saved by switching to an electric vehicle (EV) and more.

Empowering customers might also involve sharing information on rebates for energy-efficient appliances, setting up online portals for tracking personal energy usage, running community workshops on sustainable energy practices or hosting live webinars with utility experts. When customers feel they have the knowledge and tools to contribute, they’re more likely to appreciate and support the broader goals for utility sustainability.

Be Transparent

Transparency is at the heart of responsible communication. Customers value honesty, especially when it comes to utility sustainability, where “greenwashing” (the practice of making misleading claims about the environmental benefits of a product or service) has become a growing concern. Utilities that openly share their successes and challenges gain greater credibility and customer trust.

It’s important to regularly update customers on your utility’s progress toward sustainability goals. For example, PSEG releases regular reports to demonstrate its impact and continued focus on key sustainability efforts. Its most recent report gave updates on company achievements and priorities for a wide range of topics, including air emissions, energy efficiency and waste minimization.

Other ideas for transparent communications include creating a dedicated webpage or a regular newsletter section that offers progress reports on specific goals, such as emission reductions or water conservation efforts. You can also share quick updates on social media of your utility’s wins.

Being transparent about achievements andchallenges shows customers your utility’s commitment to genuine sustainability rather than only presenting a positive image.

Becoming a Leader in Utility Sustainability Communication

At a time when customers are increasingly interested in environmental issues, utilities have an opportunity to position themselves as sustainability leaders. By effectively communicating utility sustainability goals, you can foster customer support and contribute to a broader cultural shift toward environmental responsibility, benefiting both your utility and the communities you serve.