Every customer is different, so a single approach to connecting just won’t work. Customers want to see messages that align with their needs, interests and preferences and, simply stated, don’t want to be inundated with messages that don’t. In fact, according to Campaign Monitor, 74% of consumers get frustrated when content is not aligned with their interests.

As businesses, including water utilities, compete for customers’ attention, one strategy that should not be overlooked is customer segmentation. By employing this strategy, water utilities can cut through the digital clutter and deliver relevant content that matters to each customer, in turn boosting water utility customer engagement.

What is Customer Segmentation?

Customer segmentation is a marketing strategy used to identify and connect with target customers. It involves organizing customers into groups (or segments) based on shared characteristics, then tailoring outreach efforts with relevant messages.

Relevant communications with utility customers are no longer nice-to-haves — they’re expected. That’s why segmentation is crucial for water utility customer engagement. It allows utilities to better understand customers and customize communications to meet their distinct needs. To boost water utility customer engagement, your utility can segment your customer base in several ways:

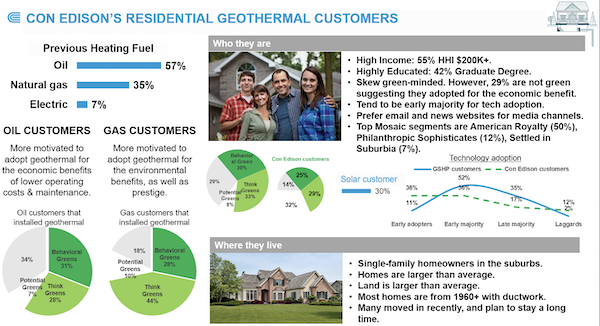

- Demographics: One of the simplest, yet most effective ways, is grouping water customers based on shared demographic characteristics, such as age, gender, income and education.

- Geographics: Geographic segmentation divides customers into groups based on their location, such as service territory, zip code or neighborhood. Your utility can target messages effectively to people who are in a particular location.

- Psychographics: This type of segmentation is based on customer interests, values and personality traits. Your water utility can determine what motivates your customers and provide value based on those interests.

- Behavioral: Group customers based on their actions, behaviors or responses. For water utilities, this could mean paying attention to what programs customers participate in or what content they engage with.

- Firmographics: Water utilities have many business customers across industries, such as agriculture, healthcare, education or retail. Water utilities need to engage these customers based on their specific industry needs.

Benefits of Customer Segmentation

The benefits of customer segmentation can be substantial — marketers who use segmented campaigns can see as much as a 760% increase in revenue.

Some of the key benefits of customer segmentation for water utilities include:

- Increased Efficiency and Performance: Targeting groups of customers rather than your entire list can be more efficient and cost-effective. By sending offerings to those customers who are genuinely interested, your utility can reduce wasted resources on ineffective marketing efforts.

- Better understanding of customers: Segmentation provides valuable insights into customer behavior and preferences, allowing your utility to gain a better understanding of what customers care about.

- Increased Customer Engagement: Tailored messages are more likely to resonate with customers, leading to higher engagement rates and increased program sign-ups.

- Improved Customer Satisfaction: Customers feel uniquely communicated with and understood through targeted communications, increasing overall customer satisfaction.

Water Utility Customer Segments

77% of return on investment comes from segmented, targeted and triggered campaigns. Segmentation for water utilities can be approached in various ways, and it can be difficult to know where to start. When grouping customers into segments, consider the following:

Residential vs. Business Customer: Residential and business customers have distinct needs, goals and interests. To ensure that your messaging resonates with a particular audience, pay attention to the type of customer that you are communicating with and tailor those messages to meet their needs.

Small vs. Large Business: ”Business customer” is a broad term that can be segmented into smaller groups. Commercial and industrial business customers differ greatly from small businesses, so it’s important to communicate messages according to employee count or facility size to increase engagement.

Recognizing that not all business customers have the same needs, newsletters are a great way to segment and curate communications based on the type of business. For example, when AEP Ohio was looking to boost engagement among its business customers, the utility took advantage of segmented newsletters through Questline Digital. The newsletters targeted individual industries like healthcare, manufacturing and retail with industry-specific educational messaging. The newsletters were so successful that AEP Ohio saw an 84% increase in customer engagement for its healthcare segment.

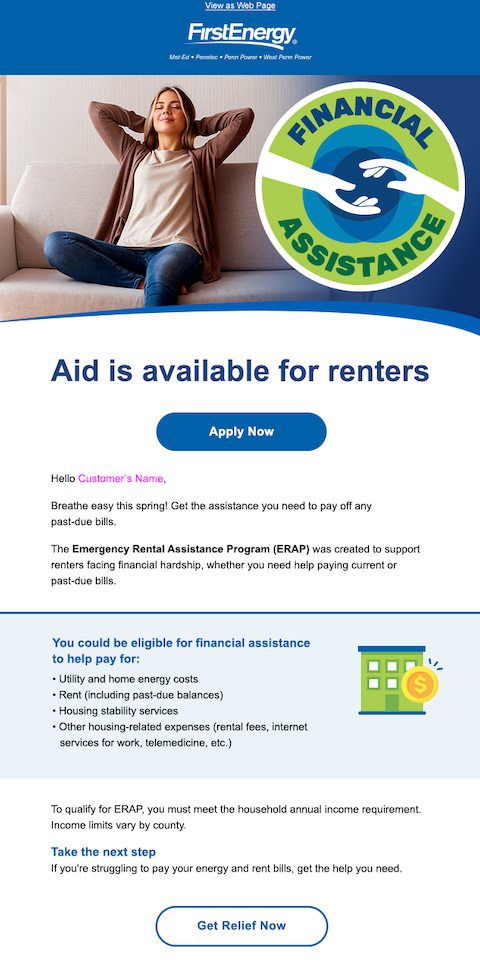

Income-based Messaging: Tailor messages about low-income assistance programs to households that meet eligibility requirements or to those identified by behavioral factors such as high bills or late payments.

When it comes to income-based messaging, your utility should only target customers who are eligible and interested. For example, FirstEnergy was seeking ways to reach customers with financial assistance programs and utilized Questline Digital’s personalized video platform, SmartVX. The technology behind SmartVX allowed the utility to send personalized information about beneficial programs to each customer (those who were eligible for the program but hadn’t yet enrolled). The segmented campaign resulted in a 162% increase in program enrollments over four months, prompting an additional 6,800 customers to apply for financial assistance.

Water Usage-Based Messaging: Segment customers based on their water usage patterns for a more targeted outreach. High-usage customers might benefit from water-saving programs and resources.

Program Promotions: Promote specific products and services tailored to segments based on their engagement with content, eligibility and previous interactions.

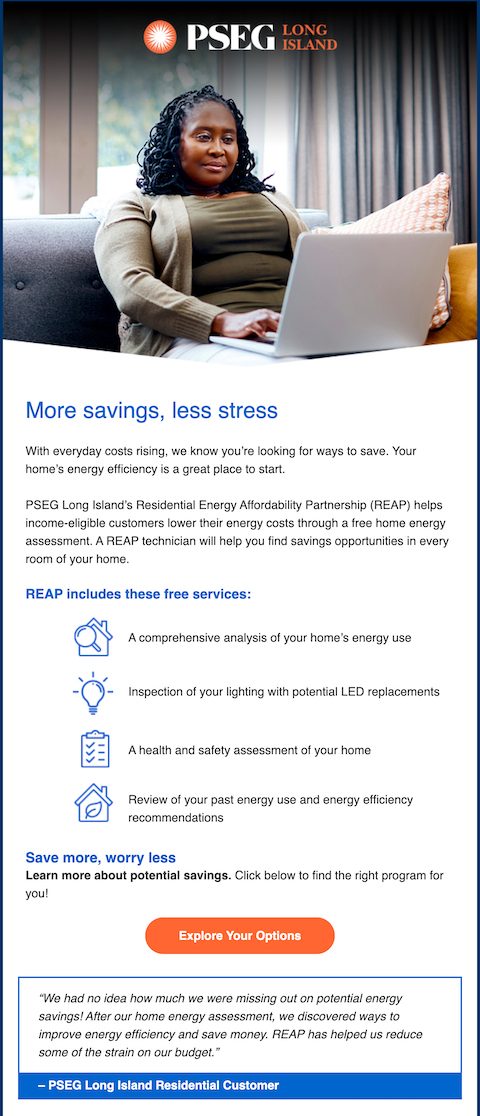

Focusing communications on segments rather than your entire customer list can yield significant results. For example, when PSEG Long Island aimed to enroll 1,200 participants in its EV rewards program, the utility began by conducting customer surveys and analyzing data to shape campaign messages and segmentation strategies. Questline Digital deployed a segmented marketing campaign spanning five months, utilizing advanced tactics such as behavioral email sends to maximize registration and enhance water utility customer engagement. PSEG Long Island surpassed its initial goal, achieving 1,300 new enrollments.

Build Stronger Customer Relationships with Segmentation

Customer segmentation is crucial for water utility customer engagement. With segmentation, your utility can drive program participation, boost conversions and increase customer satisfaction – all by delivering relevant information to target audiences. As the competition for customer attention continues to grow, implementing segmentation could be the distinguishing factor for success.

Improve water utility customer engagement and satisfaction with a segmented strategy from Questline Digital.